We are truly in the era of the customer. Gone are the days when standard products sets and a one size fits all approach was possible, as technology and intelligence propels us into an ever increasingly digital economy. Taking an outside in mind-set, it is imperative for financial service providers to reassess their purpose and direction to keep the customer at the core of the here and now – as well as medium and long-term strategies. With this in mind could hyper-personalization be the key to unlocking next level growth for the industry?

Hyper-personalization can be defined as, “harnessing real-time data to generate insights by using behavioral science and data science to deliver services, products and pricing that are context-specific and relevant to customers’ manifest and latent needs[i].” There is certainly lots of talk in the industry about offering such personalized services, but is the required investment really being put in place to action the hype?

In recent years the financial services industry has been steeped in managing increasingly complex regulatory and compliance requirements. Although time consuming and multifaceted, this has also resulted in many service providers becoming more agile and more efficient. Is now therefore the time to reinvest such efficiency savings back into the customer experience? Building competences beyond traditional banking and offering these in a truly personalized way is the future of mobilizing deeper relationship levels.

The banking industry had been making steady technological advances: Banks have been investing very heavily in going digital over the last decade. Most of these digital investments have been around omni-channel convergence, big data, analytics, customer journey mapping, user experience, chatbot and other self-service capabilities. Cloud adoption is still nascent in the Financial Services (FS) industry, and Financial Institutions (FIs) are gradually moving forward with their plans to migrate to the cloud. Today, most banks boast digital features that help their customers conduct basic banking remotely, using a browser or a mobile app. This movement has led to lower footfall into bank branches and has helped banks optimize their costs and capital expenditures.

Growing use of AI in personalization

What do you believe will be the most valuable use of artificial intelligence for banks?

Select one. (% of respondents)

Source: The Economist Intelligence Unit

For the FI’s, their investments in digital have paid off well. Most of them have seen growing volumes of interaction over digital channels. Most have a robust omni channel offering with the ability to allow their customer to acquire products or services without having to go to the branch.

External competition to accelerate the speed of change: Technology led innovations have been ongoing in the banking industry. However, with the arrival of technology players like Facebook, Amazon, Apple, and Google (FAAG) in the traditional turf of FI’s, the pace of innovation has increased rapidly. In addition to the big-tech players, FinTechs are also creating superior customer experiences for small portions of the banking value chain. From mortgages, to payments, to cards, the new age players are continuously breaching the bastions of banks.

What next for Banks: Personalization in the context of Banking is not just about the next best product offer however, using data and analytics to anticipate customer needs, which could be a product or service or advice and offering it to customers at relevant interactions with the bank creating a “nudge”. Meanwhile, doing this in real-time i.e. ‘hyper-personalization’ can expand or deepen the current customer relationships and increase trust. Today, the marketing offers from the banks are mostly mass mailer-based campaigns, offering credit cards, investment accounts etc. There is an opportunity for the banks to move away from mass marketing campaigns into hyper-personalized and targeted individualized offerings for their customers based on their interactions. This can potentially increase the acceptance rate of the offer and improve stickiness, trust, and loyalty.

Pre-cursors to Hyper-personalization: Hyper-personalization requires banks to acquire a comprehensive view of their customer, assimilating information from varied sources, correlating the data in real-time and using predictive models to make relevant offers across their choice of channels. Often, banks fail to get a comprehensive view of their customers and their interaction history because of the silos in the organization that prevents them from collaborating across LOBs for the data. To be successful, banks need to break the data silos and work across Business, Marketing, and Technology to create a seamless user experience. Once the data silo is gone, the next would be to fine tune the predictive model based on the customer interaction journey. There are opportunities to enrich the experience through augmenting bank data with external data sources that provide the view of the customer that is missing with the bank. For e.g., the extended ability to access information of a customer who may bank with other financial services provider would truly help fine-tune the models to provide contextual and personalized offers.

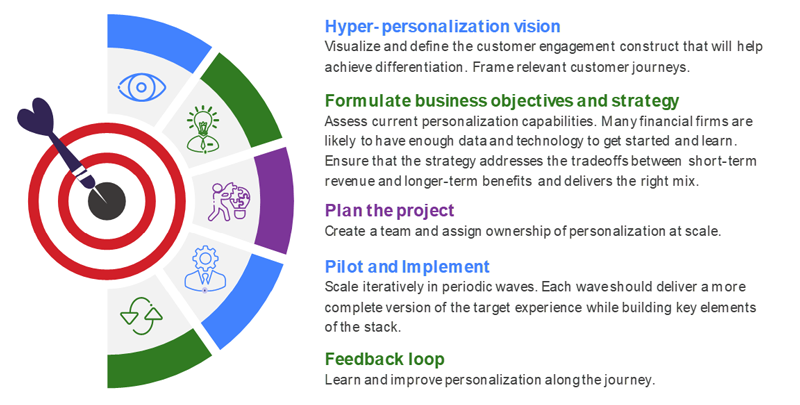

Envisioning the Hyper-personalization journey:The move towards approaching every customer interaction, irrespective of who initiates it, as an opportunity to expand and deepen customer relationship through personalization, starts with acknowledging the gaps and creating a vision around it. Once this vision is established, it needs commitment and sponsorship from management to make it a reality. Cross functionally empowered teams need to be formed with participation from Business, Risk, Marketing and Technology stakeholders that can then iterate quickly in an agile fashion to create MVP. A start small and fail fast approach helps the bank develop a feedback loop to realign and test the hypothesis.

Hyper-personalization is a powerful business differentiator, and banks stand to gain significantly from acting on it quickly and having the first mover advantage.

Taking a balanced view, we could question whether the rapid evolution of customer experience and the drive to create more comprehensive customer profiles is happening too quickly? What if when you next walked into a bank branch instead of a generic, “how can I help you?” you were greeted with an advisor who had access to AI based data and knew exactly what you’d come in for – enabling them to ask if you wanted help completing such a transaction or offer advice accordingly? Some consumers may find this intrusive and have concerns over data privacy, whilst others would appreciate a more tailored service.

There is a general expectation that when consumers provide access to their data, that in return they will be offered a more meaningful service. We are also seeing how other sectors are creating heightened customer experience expectations and how this is filtering through to the banking sector. Therefore, it really is all about knowing your customer and understanding their appetite for, and expectations around data usage and personalization. Creating customer profiles and developing multi-layered segmentation can help support this.

Ultimately hyper-personalization will boost customer experience, enable providers to be more financially inclusive and reliably deliver more contextualized and relevant services. The industry has made massive gains in digital banking and now is the time to connect the dots on personalization. A shifted focus on becoming a part of a consumer’s daily life and offering meaningful and personalized services that meet both day-to-day needs, as well as those bigger financial decisions, will embed financial service organizations into the hearts and minds of their customers for the future.