In the ever-expanding digital world, mobile banking services are the new normal economic reality. You can get mobile financial services (MFS) whether you live in the first or third world. MFS in Bangladesh has been a driving force in Bangladesh’s digital journey since its inception in 2011. Banking, payments, money transfers, and other sorts of financial activities are examples of mobile financial services. In poor nations, where many individuals do not have access to traditional banking services, mobile financial services are growing increasingly popular.

- What does “mobile financial service” mean.

- In Bangladesh, what is an Mfs Account?

- MFS services in Bangladesh

- There are a variety of mobile financial services available, including but not limited to:

- Mobile banking services in Bangladesh fact sheets

- History of MFS market players

- MFS Benefits

- MFS’s Drawbacks

- What exactly is an Mfs Provider?

- Do you know how many mobile financial services there are in Bangladesh?

- The following is a comprehensive list of mobile financial services providers in Bangladesh.

- Which mobile finance service is the finest in Bangladesh?

- Why do certain MFS suppliers go out of business?

- Regulatory controls

- The emergence of MFS and a novel Corona Virus

- MFS and the expansion of small enterprises

- Ecommerce and the MFS

- History revisited

- Conclusion

What does “mobile financial service” mean?

Mobile financial service means using your mobile phone to do things related to money, like transferring money or checking your bank account. It has been a great tool to help people without bank accounts be a part of the financial world.

In the past few years, more and more people have started using mobile financial services. This is because using your mobile phone for banking is better than using traditional banking. For instance, using mobile financial services is easier, lets you access your account anytime, and usually costs less. Also, you can use mobile financial services to send money to your friends and family, and pay for things you want to buy no matter where you are or what time it is. They don’t have to go to a bank or ATM anymore to take out or put money in their account. This is very helpful for people who are always busy and don’t have time to go to a regular bank. Another advantage of using mobile financial services is that they offer a high level of safety.

In Bangladesh, what is an Mfs Account?

In Bangladesh, an MFS account is a type of mobile financial service account that lets you use your phone to pay your bills, send money, and do other financial stuff.

MFS services in Bangladesh

In the past few years, cell phone technology has become an important tool for helping more people have access to financial services. In Bangladesh, some companies have created mobile services that let people do transactions without a bank account.

The invention of MFS has made life more fun and fast. Bangladesh Bank has always been supportive of the mobile financial service because it has positive impacts. They provide policy and overall support for it. The rules for MFS were first made in 2011. Now, the operations and operators of MFS in Bangladesh are controlled by the Bangladesh Mobile Financial Services (MFS) Regulations from 2022.

Customers can use their mobile phones to send and receive money, pay bills like water or electricity, or buy things at stores that take part in it. Mobile financial services in Bangladesh are helping people find new ways to improve their money situation. By helping people in Bangladesh access formal financial services more easily, MFSPs are contributing to reducing poverty and promoting inclusive growth.

There are a variety of mobile financial services available, including but not limited to:

- Sending money from one person to another.

- Get money.

- You can withdraw money from your mobile account by visiting an agent, bank branch, ATM, or mobile operator’s outlet.

- Selling tickets for trains, buses, and movies.

- Payments made by individuals to businesses for various bills, such as credit card bills, electricity bills, gas bills, water bills, internet bills, cable TV bills, and school/college/university bills.

- Payment for things that you buy or use.

- Government to Person Payments are financial benefits that the government gives to individuals, like old age allowances, allowances for freedom fighters, subsidies, and others.

- Giving money, items, or resources to help those in need or support a cause.

- Depositing funds from banks or using credit cards to include more money.

- Recharging your mobile phone

- Companies paying employees their salaries.

- Payment of money sent from abroad;

- Payments made by individuals to the government in the form of taxes or other levies.

- Other types of payments include small loans, exceeding account limits, regular savings, and insurance payments.

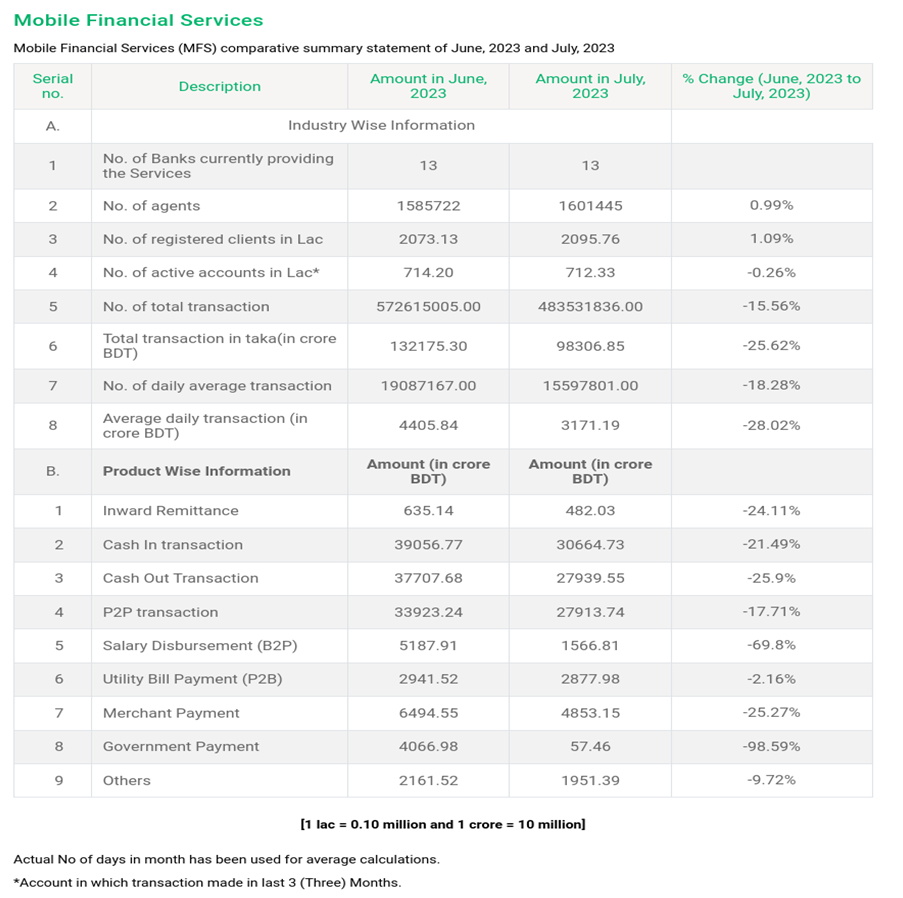

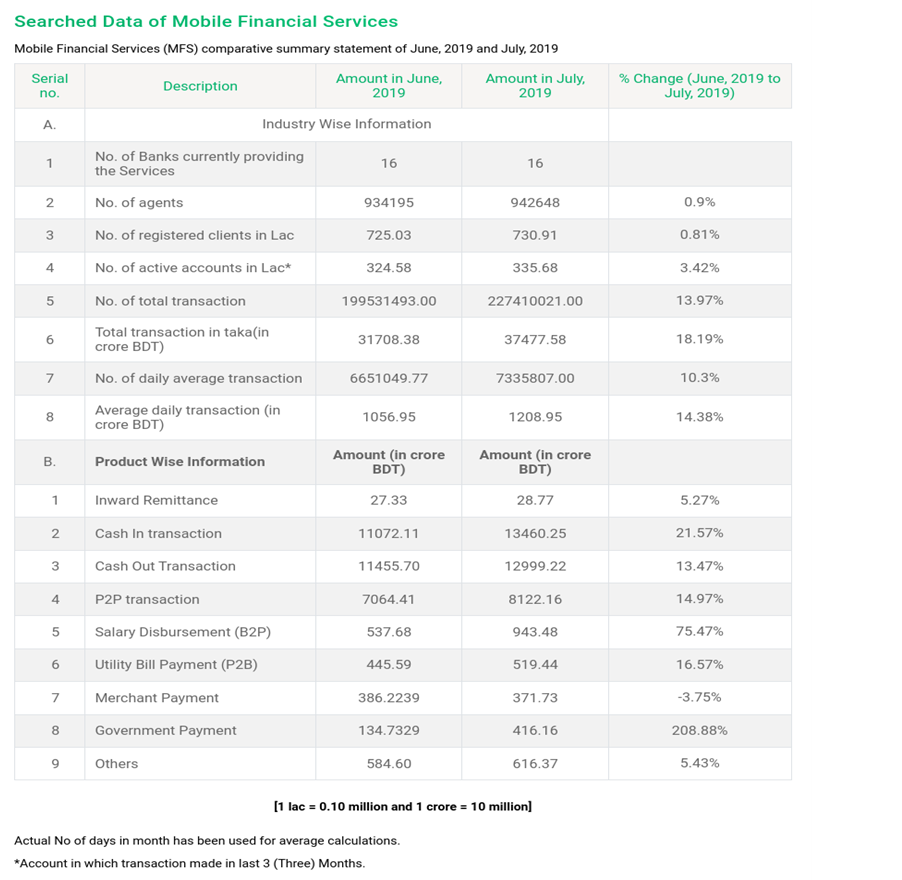

Mobile banking services in Bangladesh fact sheets

In 2023 till July

In 2019 till July

Courtesy: The Daily Star

Courtesy: The Business Standard

History of MFS market players

Bangladesh has several mobile financial service providers that cater to making the transaction of money as seamless as possible. Among them, here are the top 12 MFS providers of Bangladesh:

#bKash

bKash Limited, a subsidiary of BRAC Bank Limited, is considered to be the leading entity of the MFS industry in Bangladesh. It was launched in July 2011 as a joint venture between Money in Motion LLC and BRAC Bank Limited. Kamal Quadir and Iqbal Quadir are the two masterminds behind bKash.

Now, bKash has more than 200,000 agents, serving over 50 million verified accounts all over the country. On Fortune Magazine’s annual list of “Change the World in 2017”, bKash was featured as one of the top 50 companies bringing changes regarding social concerns. Furthermore, the MFS provider was awarded the “Best Brand of Bangladesh” recognition by Bangladesh Bank Forum in 2019 and 2020. In November 2021, as the first Bangladeshi company, bKash’s valuation became $1 billion. nitially, Bkash used to offer only three services- Cash In, Cash Out, and Send Money. However, as time passed, MFS provided by bKash increased significantly. Now through USSD and the bKash app, the provider offers all sorts of payments, salary disbursement, loan repayments, Mobile Airtime recharge, interest against savings, and distribution of foreign remittances, along with all other essential services.

# Nagad

Nagad is defined as a Bangladesh Post Office (BPO) operated Digital Financial Service, and it is the second largest MFS provider in the country. Nagad was launched on 26th March 2019 as a joint initiative between Bangladesh Post Office and Third Wave Technologies Ltd., offering services such Cash-In, Cash-Out, Mobile Recharge, and Send Money. Now it also provides services including payment services, EMI payments, Shariah MFS, and interest on savings.

After launch, Nagad also experienced a surge of subscribers. It is the second company in Bangladesh to reach $1 billion in valuation. As of December 2021, Nagad had 5.80 crore registered accounts, and it onboarded 3.35 crore customers in 2021 alone. In the same year, 75% of the government disbursement of social safety net programs was done through Nagad. In 2022, the MFS provider reached its milestone of Tk. 1,000 crore transactions in a day.

For showing exceptional growth in just a few years and its contribution to the financial inclusion goal of the country, Nagad received the Fintech Impact Award in November 2021. It also won the Digital Marketing Award, Mastercard Excellence Award, and Global Economics Award in 2021. The Global Economics also mentioned Nagad as “The World’s Fastest-Growing MFS.”

# Rocket

Dutch Bangla Bank is known to be the pioneer of mobile banking in Bangladesh. Rocket, the rebranded version of DBBL’s mobile banking system, was launched in March 2011. Its primary goal is to reach the unbanked population of the country with suitable banking services and promote saving up. Along with its banking services, the MFS provider offers services such as Cash-In, Cash-Out, payments, mobile recharge, disbursement of salaries, government allowances, foreign remittances, and the like.

One key difference between Rocket and most other MFS providers is Rocket considers each account as a deposit, not e-money in an e-wallet. Therefore, the users are able to receive DBBL’s banking services through Rocket without having to physically visit the bank. Because of this reason, Rocket’s popularity is gradually increasing. Its customer base reached 2.66 crores after onboarding 47 lakh new ones in 2021.

# Upay

Upay was launched in March 2021 as a digital financial service brand of UCB FinTech Company Limited. Operated under the authority of United Commercial Bank, Upay strives to provide easy and convenient digital financial solutions and make itself available to people from all walks of life. Its core services include bill payment, shopping, mobile transactions, remittance and salary disbursement, airtime recharge, and so forth. Although Upay has been in the industry for just over a year, it integrated itself into many other services by building a network of allies.

Through Upay, Prime Minister Sheikh Hasina sent cash gifts to 2,500 women on Bangamata’s birthday in August 2022. The MFS provider also signed an agreement with Pran-RFL Group and Fashol Dotcom to disburse salaries and other allowances. On February 2022, it signed another contract with Pathao Courier to provide cash collection solutions. For its innovative multi-wallet feature, Upay also received the “FinTech Innovation of the Year” award from the Bangladesh Brand Forum in November 2021.

# SureCash

SureCash itself is an open mobile payment platform that was launched in 2010. It offers a complete payment solution to users and payment partners, including person-to-person transactions. The MFS provider won the “Award of Excellent” by Bangladesh Bank as well.SureCash serves 20 million customers nationwide. The open payment network of SureCash currently includes partnerships with 4 local banks, 1,500 payment partners, and 180,000 retail agents. FSIBL FirstPay SureCash and Rupali Bank SureCash are the two Bangladesh Bank-approved MFS providers.

FSIBL FirstPay SureCash started operation in 2014 to make banking technology convenient to all ranges of people. This mobile service offers fast transactions, ease of operation, a secured payment system, cash deposits and withdrawals, a straightforward account opening feature, and affordable fund transfer facilities.

Rupali Bank SureCash started its journey in 2016, and since then, it has been involved in a number of Government disbursements. The MFS provider now has a customer base of one crore. It also facilitates utility bill payment, banking services, money transfers, mobile top-ups, remittance disbursement, shopping, fee payments to educational institutions, and salary disbursement for many businesses. Rupali Bank SureCash now has more than 200 distributors and 1.5 lakh agents in the country.

# mCash

mCash, a subsidiary of Islami Bank Bangladesh Ltd., started its journey on December 2012. The primary financial service offered by mCash is providing 24/7 mobile banking facilities to IBBL account holders. Through mCash, IBBL aims to reach underprivileged people with fast and convenient Shariah banking services. It also promotes cashless transactions and payments, financial inclusions, and quick disbursement of remittances.

# MYCash

In 2014, MYCash was launched as an effort to rebrand Mercantile Bank’s previous MFS brand, MPay. MYCash aims to offer its users a wide range of financial products and services that are easy and secure. The MFS provider offers services such as send money, cash in, cash out, airtime recharge, bank deposit, merchant payment, bill payment, and fee payment. The current payment partners of MYCash include Bangladesh Rural Electrification Board, Protiva Group, Golden Harvest, Aramex Dhaka Limited, Bengal Group, and more.

#Tap

Trust Axiata Pay, or Tap, is a joint venture between Trust Bank and the Asian tech investor Axiata Digital Limited. It was launched in May 2020. Tap’s goal is to offer sophisticated Digital Lifestyle Services and reform the transaction technology in the country. The MFS provider currently offers person-to-person money transfers, various fee and bill payments, payments for insurance services, merchant payments, airtime recharge, cash out, and add money. Tap also made deals with Sonali Bank and BRAC Bank to provide digital services.

# Islamic Wallet

The MFS provider, Islamic Wallet, operates under the authority of Al-Arafah Islami Bank Limited, and it was launched in December 2013. Islamic Wallet is the second Sharia-based MFS provider in the country. The primary goal of the MFS provider is to strictly maintain Shariah banking laws, rules, and regulations and offer services accordingly. To offer its users a mobile banking system that ensures the best use of their money, Islamic Wallet provides services such as fund transfer, cash-in, cash-out, bank account management, bill payment, airtime recharge, paying insurance premiums and loan installments, tuition fee payment, and so on. Moreover, to ensure full compliance with Shariah law, a highly regarded Shariah Supervisory Council is involved.

# OK Wallet

One Bank Limited launched its own MFS brand, OK Wallet, in 2018, to offer faster, safer, and more convenient services to both One Bank’s core customers and mobile banking customers. With OK Wallet, users can recharge their mobile balance, send money, shop, pay bills, transfer money, receive inward remittances, make insurance payments, and so on. OK Wallet also enables you to pay credit card bills issued by almost any bank.

# TeleCash

TeleCash, a subsidiary of Southeast Bank Limited, launched its operations in 2015. The primary goal of this initiative is to enhance customer satisfaction by facilitating fast transaction procedures. TeleCash offers services such as cash-in, cash-out, fund transfer, merchant payments, mobile recharge, bill payment, DPS payment, tuition fee, credit card bill payment, and disbursement of salaries and micro-credit.

# Tap`n Pay

Tap ‘n Pay, a 4th generation MFS, launched in 2018. It is a joint venture between Mobility, Tap Pay (Bangladesh) Limited, and Meghna Bank Limited. The MFS provider offers a prepaid account where your contact number will be your account number. You will get an NFC (Near Field Communication) card that you can tap on a POS (Point of Sales) machine and conduct a cashless money transfer. There are also NFC bracelets, key rings, and apps available. Along with money transfer, Tap ‘n Pay offers services including cash-in, cash-out, airtime recharge, money transfer, bill payment, microloan, insurance premium payment, shopping, tax payment, and disbursement of salaries and government allowances.

MFS Benefits

Mobile Financial services offer a wide range of features and advantages that are in line with the current digital age. These services have been widely adopted and have had a significant impact in many countries around the world. Numerous advantages have contributed to the growth of mobile financial services over the past decade, beginning with their introduction in Bangladesh in 2011.

- Access is available around the clock.

Mobile financial services allow people to access and manage their money at any time and from anywhere. By simply touching their phone, they can quickly see how much money they have, move money around, pay bills, and put money into different financial options. Being able to use financial services whenever and wherever you want is helpful because it saves you time and energy. This is especially helpful for people who are very busy. People can use mobile financial services anytime they want, 24 hours a day and 7 days a week. This is helpful for people who need to handle their money while they are busy or when they are away from home. For example, during an emergency or while they are traveling. It helps them feel less worried about their finances. Mobile financial services are easy and convenient ways to manage your money well. They are tools that you cannot do without. You can get your money whenever you want, even on weekends or during holidays, without any restrictions on time or days. Your mobile wallets are on your phone with you.

- Financial inclusion

MFS is a powerful tool for improving financial inclusion in developing nations. Bangladesh has successfully made use of a tool to bring remote people who are not connected to traditional banks into the financial system.

Financial inclusion means that everyone, including individuals and businesses, should be able to use basic financial services like saving money and borrowing money. Mobile financial services help people who couldn’t use regular banks to get access to various financial products and services by using their mobile phones. This is really good because it helps more people in faraway and neglected areas to use banking services. It also makes financial transactions faster and easier, and makes banking cheaper for everyone. It helps make communities more financially stable too. Mobile financial services help more people to be able to access and use money. This makes the economy grow and helps to decrease the amount of people living in poverty.

- Making the most of your money

Mobile financial services provide users with the ability to manage their finances in real-time from any location. As payments can be made instantly, users do not need to deposit beforehand and are not stuck in their fund. As a result, users are able to make optimal use of their fund. Utilizing mobile financial services to optimise one’s finances is a prudent financial decision. Mobile financial services offer a range of features, including budgeting, bill payment, and money transfer. Additionally, users can be notified of payments due and gain insight into their spending habits. Mobile financial services can save users time and money by automating savings and setting up automatic investments, as well as allowing users to compare different investment opportunities and make informed decision-making. Furthermore, users can easily access credit cards and other financial services through their mobile device.

- Increasing security

Using your mobile phone to access banking services and make financial transactions is quite safe and secure. Besides your worry, your service provider is also working hard to protect your money.

- Offering more control options

You hold the power. Your mobile money can be controlled in a variety of ways. Giving you a clear picture of where your financial data is going

- Providing you with customized alternatives

One of the biggest advantages of mobile financial services is that they offer a variety of services that are tailored to the individual needs of the user. With the help of mobile financial services, you can manage your finances from the convenience of your home or on the go. Whether it be bill payment, money transfer, investment options or more, you can easily manage your finances with the help of the mobile financial services.

With the help of a mobile financial service, you can easily keep track of your finances, avoid late payments, set automatic payments and set up alerts so that you don’t have to worry about missed payments. Mobile financial services offer a flexible and convenient way to manage your finances, which is a great advantage for many people.

- Convenience

You can quickly and easily check how much money you have, move money between accounts, put money into your account by taking a picture of a check, find where you can take out money from an ATM, and much more.

- Timesaving

The implementation of mobile financial services has drastically altered the way in which individuals manage their financial resources. The primary advantage of mobile financial services is the potential for saving time. With a few simple taps on a mobile phone or tablet, individuals can access their banking accounts, transfer money, pay invoices, and even make investments in the equity market. This reduces the need for lengthy trips to banks and ATMs, thus making financial transactions more efficient and convenient. Furthermore, the implementation of biometrics makes the process of accessing one’s financial data and making transactions even faster and safer. As a result, mobile financial services enable individuals to manage their financial resources on-the-go, thus freeing up time for other essential activities. For example, transferring funds, making payments, or checking balances are now just a few simple clicks away. Therefore, individuals no longer need to spend a significant amount of time on them.

- Hassel free banking in hand

Mobile financial services allow customers to do their banking anytime and anywhere, making it convenient for them. Nowadays, customers can use their smartphones to do banking instead of going to a bank in person. This saves time because they don’t have to wait in long lines or travel to a physical bank branch. Mobile financial services have made banking easier and more convenient for customers, especially for those who have a busy schedule or live in faraway places. Customers can now do a lot of things using their bank accounts like checking how much money they have, moving money to different accounts, paying their bills, and asking for loans. They can do all of these things at any time and from any place. This has made customers much happier and helped banks reach more customers. In summary, mobile banking services have improved the way people handle their money by offering convenient and flexible options.

- Easy to monitor

You can always keep an eye on your transactions and account balances, which helps detect any fraudulent activity.

- Good for budgeting

Since all of your transactions are monitored and recorded, you can concentrate on your most important financial goals.

- Get Financial Aid

If you’re looking for a loan, you’ve come to the right place! Mobile financial services have become a popular way to get a loan, and it’s easy to see why. You can apply online with just a few taps on your phone, from the comfort of your home or office. Plus, you don’t have to worry about visiting a bank or a financial institution. It’s fast and easy – just fill out the online application form and you’ll get your loan right away. Plus, you can choose from a range of interest rates and repayment options. All of this makes mobile financial services a great option for anyone looking to get a loan. All you need to do is apply in your app, and you’ll be able to get loans right away.

- Fund adding

You can immediately access funds from your bank accounts and credit cards in your MFS account at any time. These features are available in some cases at no cost and in some cases at a low cost

- No or low cost

MFSs are very helpful for people who want to use financial services without paying a lot of money. A big benefit of these services is that they are either very cheap or completely free. Mobile financial services are tools that let people do things with their money using their phones. These things can include sending money to other people, paying bills, and even saving money. The best part is that it doesn’t cost a lot of money to use these services. This is really helpful for people who don’t have much money to spend or can’t use regular banking services. Moreover, the fact that these services are free or inexpensive allows individuals in developing nations to use financial services without having to spend a lot of money. This is important because high fees can prevent many people from being able to use these services. Overall, using mobile financial services is a smart choice for people who want to manage their money without spending too much.

- Offers and Rewards

Getting offers and rewards is one of the best things about using mobile banking and other financial services on your phone. They make it easy for customers to save money on buying things and get extra rewards for using the service. With mobile financial services, people can get discounts, get their money back, and enjoy other special offers that are only available through the service. You can easily use these offers and rewards by redeeming them on your mobile device. Moreover, these services often have reward programs and other systems that give benefits to regular users and inspire them to continue being customers. In general, having access to deals and rewards makes mobile financial services a really good choice for people who want to save money and also enjoy the convenience and security of digital finance.

Courtesy: The Business Standard

MFS’s Drawbacks

Using mobile financial services can have some disadvantages. There are problems or disadvantages on the MFS journey. Here are some problems listed below:

.

- Excessive spending

Unnecessary spending are widespread these days since the fund is simply and rapidly transferrable. Excessive costs are a significant drawback of mobile financial services. Due to costs for transactions, account management, and other services, mobile financial services are frequently more expensive than traditional banking services. Fees may easily pile up, especially if you rely extensively on mobile banking services to manage your affairs. Furthermore, the costs connected with mobile financial services can be opaque and difficult to comprehend, leading to consumer misunderstanding and irritation. This can have a detrimental influence on mobile financial service uptake and damage the financial health of low-income and underbanked communities, who are the most in need of inexpensive financial services.

- Debt Trap

MFS provides loans and gives money quickly and easily. But having lots of money and being able to borrow money easily causes people to owe too much money. People have difficulties when they have to pay back money, and this can negatively affect their credit score. One big problem with mobile financial services is getting into a cycle of debt that is hard to get out of. People can quickly borrow money using their mobile phones, which can lead to them becoming trapped in a cycle of owing money. Lots of phone financial service companies lend money to people but charge really high interest rates. This means that the loans can easily become too expensive for the people who borrow the money. This could result in a situation where the person who borrowed the money cannot pay it back, causing them to constantly owe money for many years. Additionally, a lot of mobile financial services lack the necessary measures to keep vulnerable users safe from getting stuck in situations of debt they cannot escape from. This means that the people who really need money help are getting stuck in a never-ending cycle of owing money, and this can cause big problems for their future finances.

- Frauds and Scams

Scams and frauds happen a lot in Bangladesh. Frauds and scams are big problems with mobile banking and payment services. Mobile banking is becoming more and more popular because it is easy to use. However, there are bad people who want to take advantage of these services by finding weaknesses in them. Scammers pretend to be real organizations in order to fool people into giving away their personal and financial details. Mobile payment services can be tricked by bad people who make fake websites or apps that look real. They fool users into giving their money information. These deceits and tricks can make people lose a lot of money and make them doubt the reliability of mobile banking services. Financial organizations need to have strong security measures in place to stop fraud and make sure consumers are safe from these harmful actions. There are ways to make security better, but there are still groups that do fraud and deceive people in many different ways.

- boundary

There is a maximum amount of money you can take out each month, as well as a maximum amount you can put into your account. Every day, there are restrictions on how much you can do with your transactions. So, you are unable to transfer the amount of money you want. You need to keep the boundaries in place. The transaction limit is a problem with mobile financial services because it stops users from doing big transactions. This makes it hard for people to buy or transfer big things or money, which makes it difficult for businesses to use the platform for their money stuff. The transaction limit affects people who want to send money to their loved ones in different countries because they have to send money multiple times to reach the total amount they want to send. Moreover, people with a lot of money saved in their mobile banking account will need to take out small amounts at a time, which can be inconvenient and take a long time.

What exactly is an Mfs Provider?

A MFS provider is a company that helps businesses find the right financial services providers. They help many types of companies, like banks, investment firms, insurance companies, and pension funds. When businesses collaborate with an MFS provider, they can access more products and services. The provider will also give them advice on which options are most suitable for their needs.

MFS providers are companies that have a group of knowledgeable people who can give advice to businesses about the best financial products and services that will suit their requirements. They will consider things like how big the business is, what industry it is in, and where it is located. This means that businesses can receive personalized advice on the products and services that would be most suitable for them.

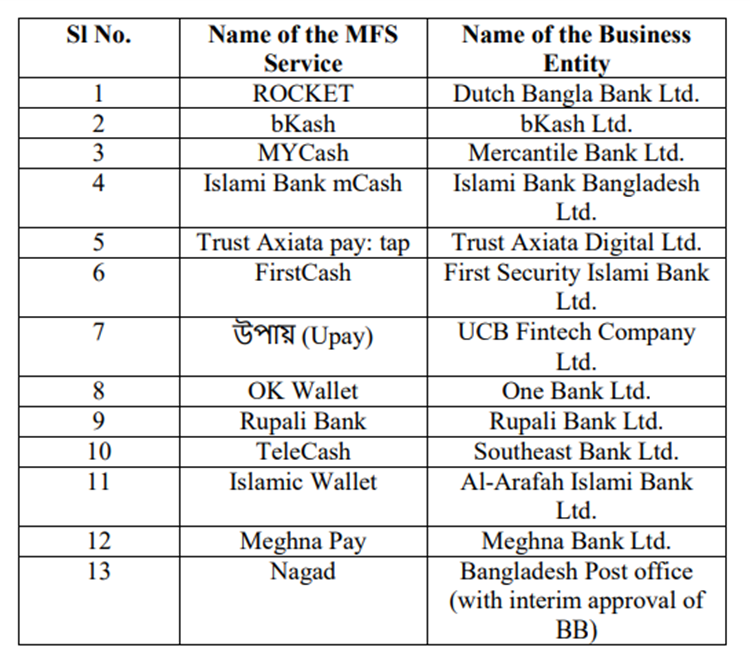

Do you know how many mobile financial services there are in Bangladesh?

Currently, there are 13 banks offering mobile financial services in the country such as bKash, Rocket, UKash, MyCash and SureCash. The following is a comprehensive list of mobile financial services providers in Bangladesh.

Courtesy: Bangladesh Bank

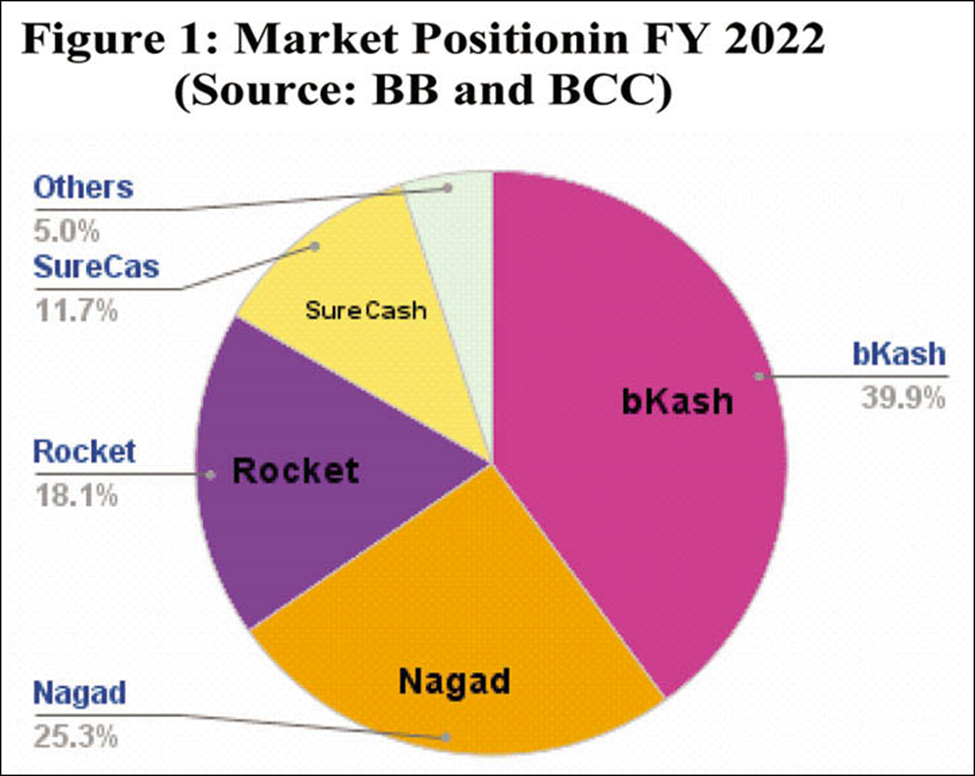

Which mobile finance service is the finest in Bangladesh?

There are a variety of mobile financial service providers (MFS) operating in the Bangladesh market, however, the majority of them are not consistently profitable and have ceased their activities. However, a select few of them are successfully executing their functions and are succeeding in the digital transformation of Bangladesh. The three most influential MFS in Bangladesh are: these three are successful in acquiring customers, innovating, being flexible, and operating efficiently. These three are responsible for approximately 90% of the customers and transactions in Bangladesh.

- Bkash by BRAC Bank Limited-The leading mobile financial service in Bangladesh and the market leader. Market Position appx 40%

- Nagad by Bangladesh Post Office-The fastest growing mobile financial service in Bangladesh. Market Position appx 25%

- Rocket by Dutch-Bangla Bank Limited- The first mobile financial service in Bangladesh. Market Position appx 18%

bKash, a subsidiary of BRAC Bank, has the highest market share, accounting for 40.07 percent or 5,39,68,418 account holders in the MFS industry. It was followed by Nagad, the digital financial service provider of the Bangladesh Post Office (officially), which makes up 25.39 percent or 3,41,96,247 account holders of the total market share, according to the study conducted by the Bangladesh Competition Commission.

Dutch-Bangla Bank’s Rocket accounts for 18.18 percent or 2,44,92,299 account holders and Rupali Bank’s SureCash 11.69 percent or 1,57,54,498 account holders.

Other 10 MFS operators including Rupali Bank’s SureCash, UCB Bank’s upay, Trust Axiata Pay, and Islami Bank’s mCash share the rest of 4.67 percent.

Why do certain MFS suppliers go out of business?

Closing an MFS account can happen for a variety of reasons. It could be because it’s too expensive to keep up with, there’s a lot of competition from other leading MFSs, or there aren’t enough customers left to make it worth it.

Regulatory controls

Bangladesh Bank, the Central Bank of Bangladesh, has implemented many supportive actions to encourage the growth of the mobile financial services ecosystem. We will talk about some of the projects carried out by Bangladesh Bank in brief:

Bangladesh Bank made rules and regulations for MFS to improve the industry. Bangladesh Bank has continuously taken care of all the rules and regulations for mobile financial services since it started in Bangladesh in 2011. The directions include:

Watching closely: Bangladesh Bank, the highest governing body of MFS, has always been closely monitoring the operations. Continuously keeping an eye on things has made sure that there are very few problems, frauds, and scams happening.

e-KYC is a major step for banks and mobile financial services (MFS) to allow people to open accounts and access their services remotely.

Bangladesh Bank made changes to the transaction limit to make it easier to do transactions. The market always focuses on setting boundaries according to what people want.

The emergence of MFS and a novel Corona Virus

The sudden increase in MFS transactions has happened during the time of the coronavirus. When other ways of banking and making payments stopped working, MFS came to the rescue to keep services going, along with ATMs. Bangladesh Bank told the companies many times to keep mobile financial services (MFS) and automated teller machines (ATMs) working smoothly during the coronavirus pandemic.

MFS and the expansion of small enterprises

Thanks to the help of mobile lenders, small businesses run on Facebook are booming. There are lots of pages with different products and services, like clothes, food, stuff for the house, decorations, books, what’s not, and so on. Now, people can run their own businesses without having to worry about making payments themselves.

Ecommerce and the MFS

MFS plays a vital role in the growth of online buying and selling platforms in Bangladesh. Ecommerce companies use online payment methods that rely on assistance from mobile financial services. But, online shopping has recently had a big decline. MFS providers are having difficulties with funds that are trapped in escrow accounts. Another difficult event happened when e-commerce companies unfairly took advantage of the refund facilities provided by the mobile financial services (MFS).

History revisited

In Bangladesh, mobile financial services have been around for the past decade, but it wasn’t until 2011 that the money transfer industry really took off. Before 2011, sending money was a big deal – it was all done through the Post Office, banks, and SA Paribahan, which was really popular for making money transfers fast and easy.

Conclusion

The flourishing industry of Mobile Financial Services in Bangladesh is undoubtedly showing immense promise. It has been offering new scopes to expand our horizon in the new era of FinTech and the financial inclusion of people regardless of where they live. Furthermore, with outstanding innovations, these competent MFS providers are streamlining economic activities in all sectors, including education, business, foreign remittance, and banking, even at the individual level. There is no doubt that the continuous evolution of MFS in Bangladesh will make it one of the prime contributors to drive the country’s economy in the near future.